How trading works in BC.Game

This allows for an innovative and exciting way in which to transfer different on BC.Game directly within the platform, in an innovative and exciting way through the “Up Down” game. Interestingly, it facilitates the ease of management of digital assets, while trading becomes exciting, taking a different angle compared to the old trading systems.

- Log into your BC.Game account. First and foremost, you should sign into your BC.Game account so that you may access the features presented on the platform.

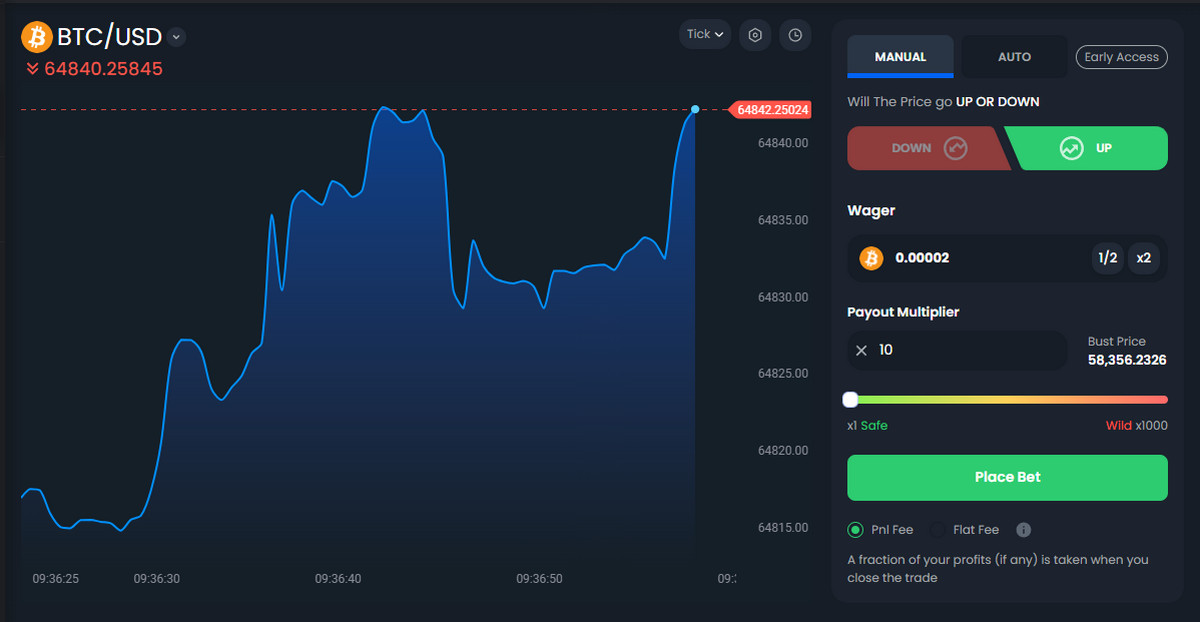

- Click on “Up Down”. On your user dashboard, scroll and click on the section given as “Up Down” in the trading section. This is the point at which trading takes place and is the perfect blend of gaming and trading.

- Choose your cryptocurrencies. Indicate the cryptocurrency from your wallet that you want to trade and which one you would like to acquire here. BC.Game supports quite a number of digital currencies, so there is quite a bit of flexibility here.

- Set the trade amount. You need to indicate the amount of cryptocurrency you intend to trade in. It may also be important to consider the limits for trades such as minimums and maximums, such that you can be sure everything goes through successfully.

What cryptocurrency pairs are available in BC.Game

On the BC.Game platform, it is possible to trade courtesy of the many cryptocurrency pairs that allow the holder to participate in either trading or futures as illustrated below. This provides a base for BC.Game to live by the provision of diverse platform trading opportunities for its customers, who exhibit a diverse range of trading strategies and preferences.

Trading pairs

All these pairs place the choice of trading these cryptocurrencies against the US Dollar in front of the user. These are meant to present a broad range of crypto traders in major and maybe some of the emerging cryptocurrencies around the world.

- BOME/USD

- BTC/USD

- ETH/USD

- DOGE/USD

- MATIC/USD

Futures pairs

Futures are provided through this combination of well-entrenched cryptocurrencies and possibly some of the new ones in the market or those not very prevalent, like BOME. The provision of these broad ranges of these pairs therefore allows traders to speculate on the future prices of these currencies against the USD, providing hedging and leveraging market movements.

- BTC/USD

- LTC/USD

- AVAX/USD

- BOME/USD

- DOGE/USD

- XRP/USD

- BCH/USD

- MATIC/USD

Basic trading strategy for beginners

This is BC.Game’s “Up Down”: a play of fun against the fluctuating landscape of cryptocurrency. Well, very far from what you usually trade in, the strategic approach may really bring life into your dive into this interesting affair.

- Start with low bets. Start your trading journey with realistic, lower bets. This will reduce your risk and allow you to learn the details and strategies on the platform without wagering large chunks of capital.

- Diversify your efforts. Diversify your bets. Spread your bets across different cryptocurrencies and temporal intervals. This would reduce the risk and open your eyes to several opportunities existing within the volatile market of the crypto world.

- Use previous insights. Leverage the historical price data that BC.Game provides for you to understand trends and patterns in price. The past performance does not necessarily resemble the future tendencies, but it can offer useful inputs into possible market behaviors.

- Keep updated. Remain informed on all the major news that might have significant influence on market sentiment and consequently on the formation of prices in order to ensure prudent decision-making in your trading.

- Set defined limits. Set maximum risk and profit objectives and exercise the discipline to stick with them.

- Be patient. The market of cryptocurrencies is inherently volatile, so patience is key. Avoid making rash decisions and wait until conditions are suitable as per your strategic parameters.

- Reflect on trading results. Make a historical analysis of your trading, including what you learned by way of both successful and less successful bets. Understanding what went wrong or right will improve your trading skills.

- Engage with the community. While it is important to think independently, you might also want to consider the bets and strategies of the BC.Game community to get an additional view that can provide more depth on current market trends.

Swing trading strategy

This is one of the most popular techniques that a trader uses to realize a stock or any other financial instrument’s gain over a period ranging from a few days to several weeks. Even though the practice did involve technical analysis, traders should not involve the latter very much in making trading decisions because the holding period of the trade is so short; they should involve the latter in fundamentally analyzing the making of their trading decisions or use both the analyses to make a trading decision.

- Unification. The overall objective in swing trading is to profit from a stock market trend or from a particular stock by trading to take advantage of that trend. This would involve buying a stock in a trending higher over several days or weeks and selling it just when it appears to be peaking, or short selling a stock that is in a downtrend and covering the short when it reaches a trough.

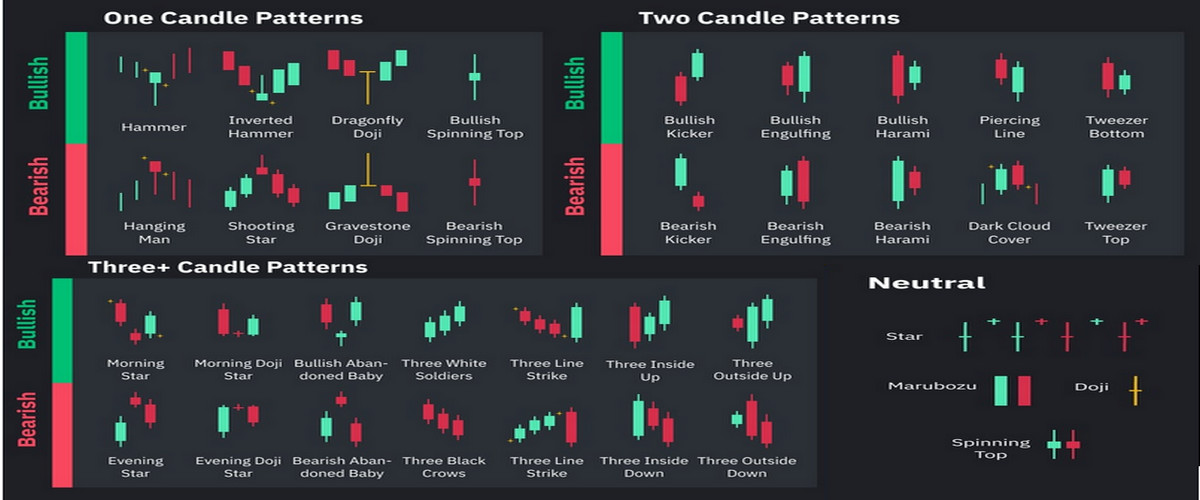

- Technical analysis. As usual, most traders follow technical analysis tools because the traders follow swing trading. They are represented in the form of visual documents for the stock’s past and current performance, which lets them take quick decisions. The common tools are:

- Moving averages. They help clarify the direction of the trend and possible reversal points in the trend.

- RSI. This is a technical momentum indicator that is applied in comparing price levels and the velocity of a market, with the aid of information signaling when the specific security is overbought or oversold.

- MACD. Moving Average Convergence Divergence is the difference between a security’s price and its two moving averages.

- Support and resistance. Price levels at which a stock tends to stop trading.

- Risk management. Such trading will also require good risk management. This should include putting in stop-loss orders where the sale of stock is allowed in the event that there is excess movement in an undesirable direction, which may potentially lead to a big loss. Similarly, good risk management will involve fixing take-profit levels in order to lock in the gains before the market starts to reverse.

- Fundamentals while. Relatively uncommon, some swing traders will add fundamental analysis to reinforce their technical findings. For instance, a trader could find a pending earnings announcement, new product introduction or other stock-price-affecting event that has its announcement date fall within the time frame of that individual trade.

- Market sentiment. It could also be the sentiments of other traders and investors that could influence a swing trader’s trading decisions over a certain stock or the general market. For instance, tools that would be vital towards this include news alerts to keep one informed, investor newsletters, and reports prepared by the market analysts.

- Execution and timing. Since swing trading strategies would be almost about capturing swings or, in other words, capturing cycles of the market, timing is crucial. It, therefore, requires a swing trader to be in a position to execute an action upon the identification of a trigger, which thus requires one to have a good trading platform and be updated on the situation that prevails while trading is in session.